Under Review: Gigacloud Technology Inc.

Description of the company⇑ index

Gigacloud Technology Inc. Is occupied with::

A B2B internet platform for large parcel goods.

GCT profiles itself as a pioneer in the field of connecting

sellers and buyers via an internet platform on the website:

https://www.gigacloudtech.com/

GCT connects merchants who manufacture their products primarily in Asia

with retailers located in the US, Asia and Europe. The company is concerned with

efficiently connecting both parties. This in the areas of payment, distribution

and regulations. It does all these activities according to a fixed price.

The large package goods (1P) contains 75% of revenue, this includes:

- Mainly furniture (60% of revenue)

- As well as household appliances and goods (11% of revenue)

- As well as fitness equipment (4% of revenue)

The services that GCT provides to its costumers for use of the platform

and other related services (3P) contains 25% of revenue.

1. 1P: The sale of goods from your own inventory

So GCT sells goods from their own inventory through

their Gigacloud platform and through other e-commerce companies

such as Amazon, Rakuten, Walmart and Wayfair.

Gigacloud expects (according to their F20 2022) that 1P category

revenues will decline as the business evolves in the future.

Much of the revenue generated through the goods from their own

inventory comes from 3P customers and is therefore no longer sold to Gigacloud.

Instead, P1-customers have evolved into P3-customers and therefore

sell them themselves via the GCT Platform. This explains expectations of decline as the future evolves.

3P: The services that GCT performs on behalf of sellers and buyers.

Services like:

Storing goods in their warehouses at a price calculated per cubic foot per day.

Delivery of goods: They mainly have their goods collected and delivered to their

customers via third parties or their own transport.

Sometimes it happens that GCT's customer asks for external transport.

In other words, the GCT customer asks Gigacloud to collect and deliver goods to

the Customer. These goods are then not the property of Gigacloud but are only

collected and delivered at the customer's request.

Sea transport services

Depending on the transaction value agreed between the seller and the buyer,

gigacloud charges between 1% and 5% commission for the use of their Gigacloud platform.

American Suppliers of goods can also use the platform to sell goods. This without

shipping the goods they offer to the GCT warehouses. By creating an account,

sellers and buyers can have their own private web space to set prices and agreements

without other buyers and sellers having access to them. This increases the

flexibility of the platform according to GCT.

The Culper Research ⇑ index

Link to: "The Culper Research Document"

- I have read the report and wonder about Culpter's questioning

of the number of employees managing the warehouses.

Coincidentally, I worked in the furniture industry as a truck driver for 5 years.

My job was to deliver +- 10 pieces of furniture to the customer every morning.

The people responsible for preparing the furniture for delivery were John and Yves.

John and Yves were responsible for a warehouse of 10000m2 or 107639 square feet.

If I go by the report in which sculpter cites that the 73 employees in the United States

are responsible for 3780000 square feet or 351174m2, this amounts to:

3780000 / 107639 = 35.12 warehouses

So you need 35.12 Johns and 35.12 Yves to move the same amount of furniture

and large goods smoothly through a warehouse on location.

35.12 x 2 = 70.24 or +-70 employees.

Which therefore corresponds to the feasibility and number of employees

you need to run a warehouse with furniture!

Culper also does not take into account subcontractors or external personnel via outsourcing!

What also strikes me about the report is that Culpter makes the comparison with Amazon, Wallmart and Wayfair and ashley furniture. I hereby ask myself a few questions;

Since when does Amazon only do furniture? In other words, Amazon does much more than just furniture... All kinds of goods such as clothes, electrical equipment, jewelry, etc.

That is also why a company like Amazon needs many more employees to bring all these smaller goods to the right location in their warehouses and send them individually to the right customer. In my opinion, the comparison between Amazon and Gigacloud makes no sense at all!

I also wonder about the comparison with Ashley Furniture. The report mentions 350 employees... 350 employees across the entire company, I would think... so it is not known how many are walking around in the warehouse. This company also does smaller goods such as decoration.

Which cannot be compared with Gigacloud!

Culper points out that the photos GCT uses are not original photos from their warehouses.

In all honesty, as a truck driver I see warehouses with all kinds of goods every day.

One warehouse is state of the art with goods that do not have much value.

Compared to another warehouse where it rains inside and rats crawl around.

In the case of GCT, I would dare to say that it concerns leased warehouses

with the necessary defects and therefore NOT really visible to the general

public. If they did this anyway and showed real photos of their warehouses,

this could lead to damage to their image. .

This could also explain the photos used from, for example, 'Shutterstock'.

Culper points out that the company has only used vehicles for its own use

and that is possible. I personally find the fact that a telephone conversation

is included in the file a bit dubious. Back the same as mentioned in

point 3. The company wants to present itself better and certainly not by

telephone (a matter of adopting a skeptical attitude and not showing the

back of your tongue to a complete stranger on the telephone). That's why

the lady says that it is gigacloud that provides the delivery.

In the 2022 20F, Gigacloud clearly states that they work with

the best-known suppliers such as fed-ex and ect.

The job positions are currently clearly visible on the GCT website. There is even 1 job position that the AI side must maintain due to machine learning.

See link: https://www.gigacloudtech.com/careers#jobOpenings

The report was written by a company active in short-selling.

The Culper company therefore has every interest in seeing the share price drop!

The report says that Gigacloud will no longer report as an F-20 company,

which to me is clearly NOT correct! If you look at the link that Culper

itself provides, you will come to the GCT page where it clearly states

that they will comply with ALL conditions that every other American

company must report to the SEC! Gigacloud will therefore be even more

compliant than before and therefore not less compliant as Culper states!

Link to Gigacloud Announcement

source: Culper Research Document

Why this Company? ⇑ index

Because of the ROIC and the Debt To Equity ratios that

do not meet the investment conditions that I impose on myself,

I still invested in Gigacloud Technology Inc. in this case.

Why?

In my opinion the company is undervalued. For the time being,

I have only invested 1/5th of my normal investment amount per company in GCT.

If the debt costs and ROIC go in a positive direction and the company is still undervalued

by then, there is a chance that I will buy some more shares!

Via Google I found some interesting data regarding:

with the market growth of the furniture sector as a whole.

See for example this link:

the global economy as a whole is shifting towards more production

and sales of local goods. Better to keep een eye on this shift.

As for now this is not a problem for Gigacloud.

Intellectual property ⇑ index

Gigacloud Technology Inc. According to the 22 Annual Report,

has various Intellectual properties. These Intellectual Properties

are active in various forms in America, Hong Kong and other countries.

gigacloud's customers are divided into 2 groups.

1. 3P Sellers

This group is growing year after year. From 210 sellers in 2020 to 560 sellers

in 2022. This mainly concerns Asian sellers who offer their goods on

the Gigacloud platform and/or use the services of GCT.

2. Buyers

This group also grows every year. From 1689 buyers in 2020 to 4156 buyers in 2022.

This mainly concerns buyers located in the United States, Europe and Japan.

This group are resellers who can buy via the GCT platform or via,

for example, Amazon and/or Wayfair.

The change in the Furniture Market and the online retail market is

increasingly moving from brick-and-mortar stores to online shopping.

Gigacloud responds to this as a provider of furniture and other retail

products via their online platform.

Not only the end user buys his goods online, but also the reseller

is increasingly doing this online. So the change from physical stores

to online furniture purchases is on the rise. It is therefore interesting

for many resellers not to have to invest in large warehouses and

therefore have to purchase stock.

Gigacloud responds perfectly to this and has the warehouses and transport options.

Gigacloud itself states that the reseller may sell his product to the end user

and only then must order his piece of furniture on the GCT platform.

The competition from the entire e-commerce landscape is real.

Nowadays, e-commerce is a permanent global phenomenon and there is therefore

competition every day that tries different ways to be the best in terms of

delivery, price and quality of products.

Which might work to Gigacloud Technology Inc.'s advantage.

Is that they are in the niche market in the field of large goods.

In other words they specialize in having large goods transported.

Moving away from seats, cabinets, fitness equipment, etc.

Since this requires a lot of storage capacity as well as the right transport and connections,

I personally think that this is to the advantage of GCT and this will discourage

the competition in the future from entering this niche given the investments

and knowledge that competing parties must have.

Gigacloud itself states that they consider 1 competitor as a possibility.

In particular the company: https://www.faire.com/

Faire.com is a company that is not present on the stock market.

The company also focuses on B2B and enables (small) sellers from only

North America, Canada and Europe to sell their products to

Professional Retailers.

Their business model involves using B2B

without the influence of the Asian market and therefore only

connecting small self-employed people who are locally based.

The company also sells small goods such as jewelry, decoration, etc.

Faire.com is also competing with Walmart and/or Amazon.

These companies are also active in the sale of goods produced in low-wage countries

and therefore support the local economy less. Since Gigacloud sells

on Amazon, etc. and profiles itself as an intermediary in the

distribution of large goods, this is not a direct competitor.

However, it is something to keep an eye on, as the global economy

as a whole is shifting towards more production and sales of local goods.

Management & Direction ⇑ index

The first impression of management is positive.

It is important to indicate that management must have been active in the company

for several years. Therefore not in the same position, but involved in the company's

activities for several years. Even more important is when management and/or directors

have shares in the company. Which is the case here.

When management or directors own shares in the company, this can indicate the fact

that they believe in the activities that the company carries out and therefore

benefit these people as the company grows!

THE BOARD

THE MANAGEMENT

Some useful facts about the people who run the company:

Larry Lei Wu, Founder, Chairman, Director and Chief Executive Officer, Sedert 2006

Frank Lin, Director, since 2006

Involved as director in various companies, including 'VIPS' Vipshop Holdings Limited.

As well as an online platform in China (vip.com, vipshop.com)

that offers all types of retail goods.

Jan (John) William Visser, Independent Director, since 2018

Worked at WALMART for 19 years in various positions.

Lorri Kelley, Independent Director, since 2018

Has a very long history in the furniture sector. This lady has been involved

in various management roles in the furniture industry for 30 years.

Insider Ownership

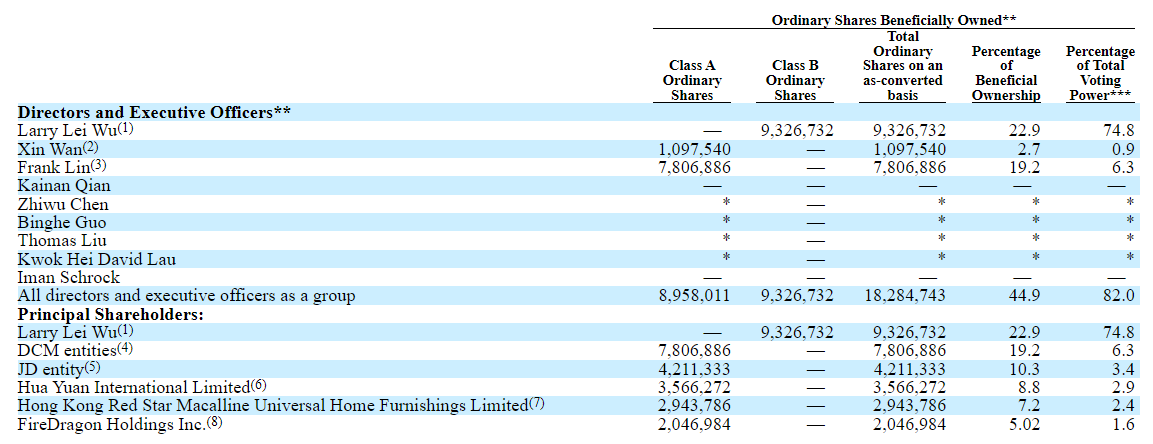

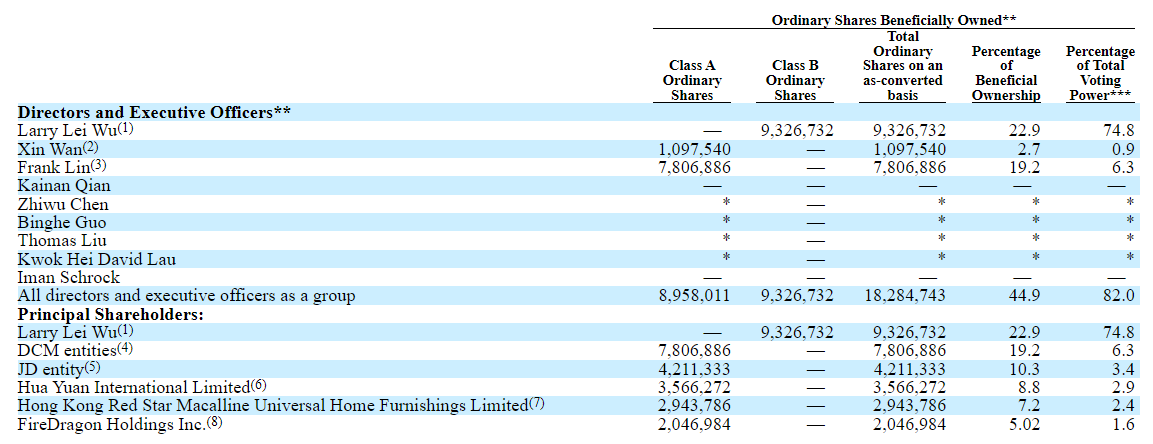

The management and board of directors together own a total of 18.28M shares.

If we compare this with the total number of shares of 40.75M, we arrive at a percentage of 44.87%.

When screening for companies to invest in, this company meets the requirement

of having at least 10% insider ownership. In other words: the number of shares

that the people involved in the business process must at least have is

higher than 10%. So this company is eligible to invest in.

When the owner and employees have shares in the company, this means

that these people believe in the future of the company. So they will

do everything they can to grow the company, since they have invested

their own money in their own company by purchasing these shares.

See below a table showing the shareholdings of the owners of the GCT:

Source:GCT FORM 20-F 2022

Financial Ratios (anno 2022) ⇑ index

| Total Equity |

Total Assets |

Total Liabilities |

| $195,2M |

$418,6M |

$223,4M |

Return On Equity: 15%

The ROE is above a minimum of 15% and the company therefore qualifies as an investment.

The ROE was also stable in the last 2 previous years. So we assume that the company

can achieve the same in the future. As long as this ratio remains above 15%.

Return On Invested Capital: 7.92%

We would like to see a ROIC percentage above 15%. GCT has a percentage

of 7.92% which is below 15%. The rule we impose on ourselves is that

we achieve a minimum ROIC of 12%.

FYI: Higher ROIC percentages have already been achieved in the past.

- 2020:39,9%

- 2021:18,02%

- 2022:7,92%

- 2023:?

Debt to Equity: 1.14

We see that the DTE ratio is above 0.5

The Debt To Equity ratio is a bit on the high side.

Normally I prefer to see a figure of around 0.5.

Free Cash Flow: $49M

In itself the FCF does not want to say much.

Where it gets really interesting is when we put the FCF into a

Discount-Cash-Flow method and we therefore calculate what the company

will generate in the future. We do this very conservatively and

create a DCF that is constructed with a large margin of safety!

The result of our DCF is: $538.75M

So we assume the company is currently worth $538.75M. We do make one important correction here.

We take a Margin Of Safety into account and take the 538.75 and calculate 60% of this.

Then we arrive at the amount of $323.25M and assume that the

company is currently buyable when the company has a Market Cap of: $323.25M

at the time of writing, Gigacloud has a Market Cap of $390.78M, which is above the calculated $323.25M.

Personally, I would keep an eye on the stock from the present and wait until

we get as close to the calculated amount as possible.

We then divide 323.25 by the number of outstanding shares (40.68M), which justifies a price of $7.94.

Why should you invest in Gigacloud Technology Inc.?

- Niche industry GCT mainly trades in large goods.

- Growing sector mainly buying and selling online.

- Lots of controversy surrounding the company, see Culper report.

This creates uncertainty on Wall Street, causing the share price to drop.

Which is ideal to get in!

- Gigacloud is transitioning from a Hong Kong-based company to a company

that focuses on the American and European markets.

For example, it purchased the goods from the bankrupt "Noble House"

and there is a chance that they will be transferred from a foreign entity

to a full-fledged American listed company that meets all SEC conditions.

In other words, the company will report all its quarterly returns,

annual returns and mandatory disclosures like any other US-based company.

This would normally be in early 2024 must be completed.

Why should you NOT invest Gigacloud Technology Inc.

- The controversy surrounding the company due to the Culper report.

- If you don't want to wait longer than 3 years for your investment to pay off,

I would not recommend investing in GCT. If you have a lot of patience and plan

to buy and stick around for a long time, I would say do it! When the course is arround $7.94, you buy!